Since 2010, Unity Financial Partners have been assisting British nationals moving to or already resident in Italy to understand how their savings and pensions may be treated as well as helping to make sure that existing financial arrangements are structured so as to be effective, efficient and compliant for Italian residence.

Recently, Italy was crowned “Country of the Year” for 2021 by The Economist, an annual honour awarded by the respected British weekly newspaper stating that “The prize is given not to the richest or the happiest, but to the one that in our view improved the most in 2021”. The accolade concluded with “It is hard to deny that the Italy of today is a better place than it was in December 2020. Augoroni!”

One area where Italy has undoubtedly improved significantly is tax compliance.

Many British nationals have encountered problems when expecting their UK financial adviser or financial institution to advise them on Italian tax efficiency and compliance with many still charging fees for advice and services which do not work for Italian residents and where mistakes can be very costly.

Setting up your savings and pension arrangements to be tax efficient and compliant for Italian residence is usually quite straightforward provided you are prepared to pay for advice and not rely only on social media and google.

This is the first of three articles which will focus on some of the basics.

Cash Flow Planning and the use of different financial asset classes

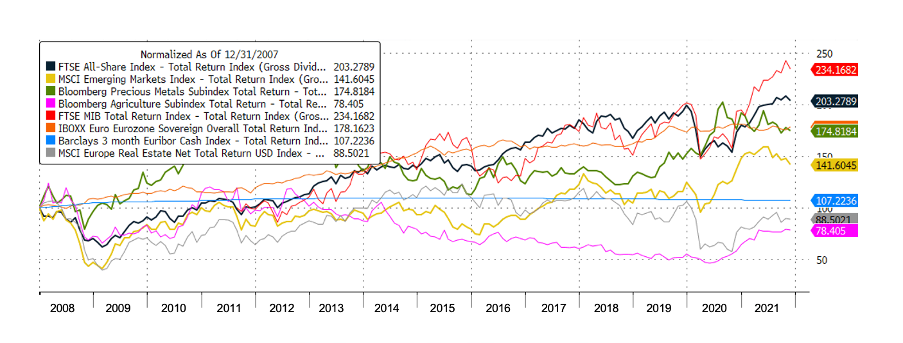

Behaviour of different financial asset classes

Bank Accounts – How Safe are they?

The EU deposit guarantee scheme protects depositors savings by guaranteeing deposits of up to €100,000. The equivalent UK scheme provides for £85,000. Many jurisdictions provide very little or no protection whatsoever.

During the global financial crisis of 2008, many failed banks were bailed out by governments. Current arrangements prohibit this.

Bank Accounts – Inflation Risk

Cash is widely considered to have the lowest degree of risk, however with interest rates close to or below zero, money held in the bank potentially devalues over time in real terms due to inflation and bank charges.

Covid economic stimulus, Central bank quantitive easing as well as food and energy price rises are some of the reasons for higher inflation. As inflation increases, the value of cash decreases as does your ability to buy goods and services in the future.

Bonds – Government and Corporate

Corporate bonds usually offer a higher yield than government bonds because their credit risk is generally greater. UK, US and European government bond yields are still close to an all time low but now rising due to inflation. Government bonds in most major emerging economies are currently providing a higher yield but the debt to GDP (gross domestic product) ratio is fast accelerating.

Both green and social impact bonds are proving to be attractive alternatives.

Equities – No Risk / No Return

Equities have significantly outperformed government bonds and cash over the medium and long term. Equities have proven to be the most effective hedge against inflation over the long term but higher volatility may make equities unsuitable for short term savings.

Sustainable Investments – Positive Impact with Competitive Returns

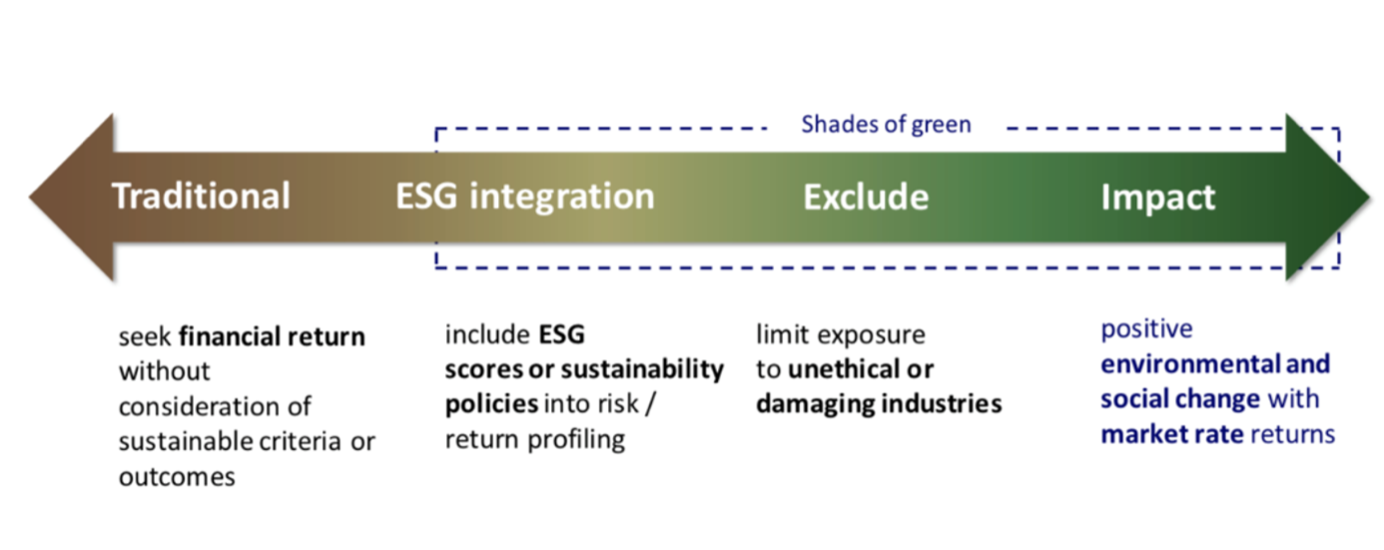

Sustainable investments can be described as those which are used to transition the economy towards a more sustainable and equitable future. Sustainable investments not only seek financial returns but also consider the non-financial impact and ESG (Environmental, Social and Governance) aspects.

Green and impact equity and bond funds are proving to be attractive alternatives to traditional funds. The sector is growing rapidly.

Where will your money flow to?

Asset Allocation – Cash Flow Requirements

It is important to check that your current asset allocation matches with your short, medium and long term cash flow requirements and that you have calculated your income and expenditure as accurately as possible.

If you are looking to use your savings to provide a regular income then a diversified portfolio of investments targeting both yield and capital growth would be advisable.

If you want to preserve and grow the value of your savings above the rate of inflation then a conservative portfolio allocation may be suitable.

If your main objective is to grow your savings over the longer term and significantly beat inflation then a growth allocation may be preferrable.

How We can Help – Putting it all Together

To make sure your savings and pensions are structured to be cost effective, tax efficient and compliant with your residence in Italy, please contact us by email on [email protected] to arrange a review.

Please also forward this article to any British friends who may find this helpful.